Page 63 - Microsoft Word - One-Report-Eng 2024 Final.docx

P. 63

Tycoons Worldwide Group (Thailand) Plc.

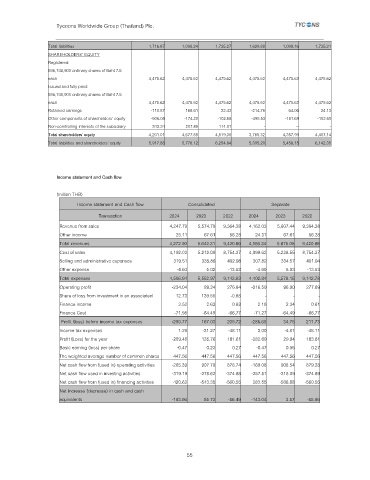

Total liabilities 1,716.87 1,098.24 1,735.27 1,629.88 1,098.16 1,735.21

SHAREHOLDERS’ EQUITY

Registered:

596,748,900 ordinary shares of Baht 7.5

each 4,475.62 4,475.62 4,475.62 4,475.62 4,475.62 4,475.62

Issued and fully paid:

596,748,900 ordinary shares of Baht 7.5

each 4,475.62 4,475.62 4,475.62 4,475.62 4,475.62 4,475.62

Retained earnings -110.87 168.61 32.43 -214.76 64.06 34.13

Other components of shareholders’ equity -506.08 -174.20 -102.68 -495.53 -181.69 -102.60

Non-comtrolling interests of the subsidiary 342.34 207.85 114.01 - -- -

Total shareholders' equity 4,201.01 4,677.88 4,519.38 3,765.32 4,357.99 4,407.14

Total liabilities and shareholders' equity 5,917.88 5,776.12 6,254.64 5,395.20 5,456.15 6,142.35

Income statement and Cash flow

(million THB)

Income statement and Cash flow Consolidated Separate

Transaction 2024 2023 2022 2024 2023 2022

Revenue from sales 4,247.79 5,574.70 9,364.38 4,162.03 5,607.44 9,364.38

Other income 25.11 67.61 56.28 24.31 67.61 56.28

Total revenues 4,272.90 5.642.31 9,420.66 4,186.34 5.675.05 9,420.66

Cost of sales 4,192.03 5.212.09 8,754.37 4,099.62 5.238.55 8,754.37

Selling and administrative expenses 319.51 335.86 402.98 307.82 334.57 401.94

Other expense -4.60 5.02 -13.53 -4.60 5.03 -13.53

Total expenses 4,506.94 5,552.97 9,143.82 4,402.84 5,578.15 9,142.78

Operating profit -234.04 89.34 276.84 -216.50 96.90 277.89

Share of loss from investment in an associated 12.73 139.55 -0.98 - - -

Finance income 2.52 2.63 0.62 2.18 2.34 0.61

Finance Cost -71.98 -64.49 -66.77 -71.27 -64.49 -66.77

Profit (loss) before income tax expenses -290.77 167.03 209.72 -285.60 34.75 211.73

Income tax expenses 1.29 -31.27 -48.11 3.00 -4.81 -48.11

Profit (Loss) for the year -289.48 135.76 161.61 -282.60 29.94 163.61

Basic earning (loss) per share -0.47 0.23 0.27 -0.47 0.05 0.27

The weighted average number of common shares 447.56 447.56 447.56 447.56 447.56 447.56

Net cash flow from (used in) operating activities -285.39 907.70 878.74 -169.08 908.54 879.28

Net cash flow used in investing activities -319.19 -278.62 -374.68 -257.51 -318.09 -374.69

Net cash flow from (used in) financing activities 420.62 -543.35 -560.55 283.55 -586.88 -560.55

Net increase (decrease) in cash and cash

equivalents -183.96 85.73 -56.49 -143.04 3.57 -55.96

55