Page 55 - Annual Report English 2018

P. 55

Tycoons Worldwide Group (Thailand) Plc.

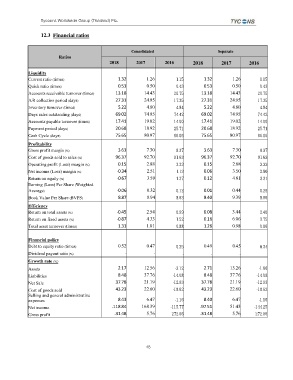

12.3 Financial ratios

Consolidated Separate

Ratios

2018 2017 2016 2018 2017 2016

Liquidity

Current ratio (times) 1.32 1.26 1.15 1.32 1.26 1.15

Quick ratio (times) 0.53 0.50 0.43 0.53 0.50 0.43

Accounts receivable turnover (times) 13.18 14.43 20.75 13.18 14.43 20.75

A/R collection period (days) 27.31 24.95 17.35 27.31 24.95 17.35

Inventory turnover (times) 5.22 4.80 4.84 5.22 4.80 4.84

Days sales outstanding (days) 69.02 74.95 74.42 69.02 74.95 74.42

Accounts payable turnover (times) 17.41 19.02 14.00 17.41 19.02 14.00

Payment period (days) 20.68 18.92 25.71 20.68 18.92 25.71

Cash Cycle (days) 75.65 80.97 66.06 75.65 80.97 66.06

Profitability

Gross profit margin (%) 3.63 7.30 8.37 3.63 7.30 8.37

Cost of goods sold to sales (%) 96.37 92.70 91.63 96.37 92.70 91.63

Operating profit (Loss) margin (%) 0.15 2.88 3.33 0.15 2.88 3.33

Net income (Loss) margin (%) -0.34 2.51 1.13 0.06 3.50 2.80

Return on equity (%) -0.67 3.59 1.37 0.12 4.81 3.31

Earning (Loss) Per Share (Weighted

Average) -0.06 0.32 0.12 0.01 0.44 0.29

Book Value Per Share (BVPS) 8.87 8.94 8.63 9.40 9.39 8.96

Efficiency

Return on total assets (%) -0.45 2.54 0.99 0.08 3.44 2.40

Return on fixed assets (%) -0.87 4.33 1.52 0.16 6.06 3.75

Total asset turnover (times) 1.31 1.01 0.88 1.26 0.98 0.86

Financial policy

Debt to equity ratio (times) 0.52 0.47 0.35 0.49 0.45 0.34

Dividend payout ratio (%) - - - - -

Growth rate (%)

Assets 2.17 12.56 -3.12 2.71 13.26 -1.66

Liabilities 8.48 37.76 -14.08 8.48 37.76 -14.08

Net Sale 37.78 21.19 -12.93 37.78 21.19 -12.93

Cost of goods sold 43.23 22.60 -18.62 43.23 22.60 -18.62

Selling and general administrative

expenses 8.43 6.47 -1.16 8.40 6.47 -1.16

Net income -118.84 168.39 -115.77 -97.51 51.43 -144.25

Gross profit -31.48 5.76 272.96 -31.48 5.76 272.96

48