Page 102 - Annual Report English 2018

P. 102

Tycoons Worldwide Group (Thailand) Plc.

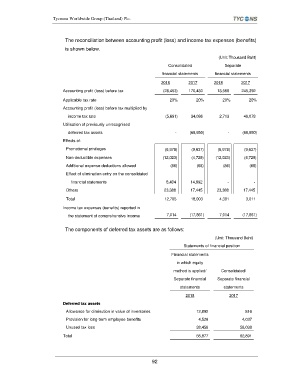

The reconciliation between accounting profit (loss) and income tax expenses (benefits)

is shown below.

(Unit: Thousand Baht)

Consolidated Separate

financial statements financial statements

2018 2017 2018 2017

Accounting profit (loss) before tax (28,453) 170,430 13,566 245,392

Applicable tax rate 20% 20% 20% 20%

Accounting profit (loss) before tax multiplied by

income tax rate (5,691) 34,086 2,713 49,078

Utilisation of previously unrecognised

deferred tax assets - (69,950) - (69,950)

Effects of:

Promotional privileges (6,978) (9,637) (6,978) (9,637)

Non-deductible expenses (12,023) (4,729) (12,023) (4,729)

Additional expense deductions allowed (86) (68) (86) (68)

Effect of elimination entry on the consolidated

financial statements 8,404 14,992 - -

Others 23,388 17,445 23,388 17,445

Total 12,705 18,003 4,301 3,011

Income tax expenses (benefits) reported in

the statement of comprehensive income 7,014 (17,861) 7,014 (17,861)

The components of deferred tax assets are as follows:

(Unit: Thousand Baht)

Statements of financial position

Financial statements

in which equity

method is applied/ Consolidated/

Separate financial Separate financial

statements statements

2018 2017

Deferred tax assets

Allowance for diminution in value of inventories 12,892 816

Provision for long-term employee benefits 4,529 4,037

Unused tax loss 38,456 58,038

Total 55,877 62,891

92