Page 106 - Annual Report English 2018

P. 106

Tycoons Worldwide Group (Thailand) Plc.

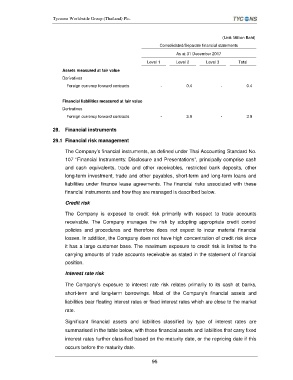

(Unit: Million Baht)

Consolidated/Separate financial statements

As at 31 December 2017

Level 1 Level 2 Level 3 Total

Assets measured at fair value

Derivatives

Foreign currency forward contracts - 0.4 - 0.4

Financial liabilities measured at fair value

Derivatives

Foreign currency forward contracts - 3.9 - 3.9

29. Financial instruments

29.1 Financial risk management

The Company’s financial instruments, as defined under Thai Accounting Standard No.

107 “Financial Instruments: Disclosure and Presentations”, principally comprise cash

and cash equivalents, trade and other receivables, restricted bank deposits, other

long-term investment, trade and other payables, short-term and long-term loans and

liabilities under finance lease agreements. The financial risks associated with these

financial instruments and how they are managed is described below.

Credit risk

The Company is exposed to credit risk primarily with respect to trade accounts

receivable. The Company manages the risk by adopting appropriate credit control

policies and procedures and therefore does not expect to incur material financial

losses. In addition, the Company does not have high concentration of credit risk since

it has a large customer base. The maximum exposure to credit risk is limited to the

carrying amounts of trade accounts receivable as stated in the statement of financial

position.

Interest rate risk

The Company’s exposure to interest rate risk relates primarily to its cash at banks,

short-term and long-term borrowings. Most of the Company’s financial assets and

liabilities bear floating interest rates or fixed interest rates which are close to the market

rate.

Significant financial assets and liabilities classified by type of interest rates are

summarised in the table below, with those financial assets and liabilities that carry fixed

interest rates further classified based on the maturity date, or the repricing date if this

occurs before the maturity date.

96