Page 53 - Annual report eng 2020

P. 53

Tycoons Worldwide Group (Thailand) Plc.

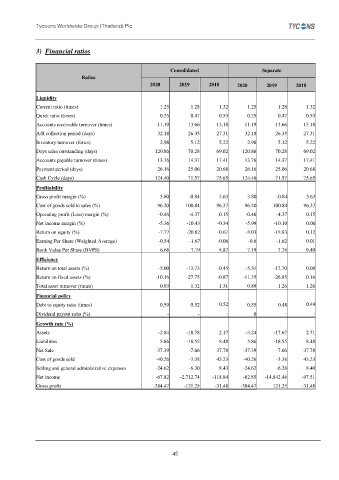

3) Financial ratios

Consolidated Separate

Ratios

2020 2019 2018 2020 2019 2018

Liquidity

Current ratio (times) 1.25 1.28 1.32 1.25 1.28 1.32

Quick ratio (times) 0.25 0.47 0.53 0.25 0.47 0.53

Accounts receivable turnover (times) 11.19 13.66 13.18 11.19 13.66 13.18

A/R collection period (days) 32.18 26.35 27.31 32.18 26.35 27.31

Inventory turnover (times) 2.98 5.12 5.22 2.98 5.12 5.22

Days sales outstanding (days) 120.86 70.28 69.02 120.86 70.28 69.02

Accounts payable turnover (times) 13.76 14.37 17.41 13.76 14.37 17.41

Payment period (days) 26.16 25.06 20.68 26.16 25.06 20.68

Cash Cycle (days) 124.40 71.57 75.65 124.40 71.57 75.65

Profitability

Gross profit margin (%) 3.80 -0.84 3.63 3.80 -0.84 3.63

Cost of goods sold to sales (%) 96.20 100.84 96.37 96.20 100.84 96.37

Operating profit (Loss) margin (%) -0.46 -4.37 0.15 -0.46 -4.37 0.15

Net income margin (%) -5.36 -10.43 -0.34 -5.99 -10.10 0.06

Return on equity (%) -7.77 -20.82 -0.67 -8.03 -18.83 0.12

Earning Per Share (Weighted Average) -0.54 -1.67 -0.06 -0.6 -1.62 0.01

Book Value Per Share (BVPS) 6.66 7.19 8.87 7.19 7.78 9.40

Efficiency

Return on total assets (%) -5.00 -13.73 -0.45 -5.31 -12.70 0.08

Return on fixed assets (%) -10.16 -27.75 -0.87 -11.35 -26.85 0.16

Total asset turnover (times) 0.93 1.32 1.31 0.89 1.26 1.26

Financial policy

Debt to equity ratio (times) 0.59 0.52 0.52 0.55 0.48 0.49

Dividend payout ratio (%) - - - 0 - -

Growth rate (%)

Assets -2.84 -18.78 2.17 -3.24 -17.67 2.71

Liabilities 5.86 -18.55 8.48 5.86 -18.55 8.48

Net Sale -37.39 -7.66 37.78 -37.39 -7.66 37.78

Cost of goods sold -40.26 -3.38 43.23 -40.26 -3.38 43.23

Selling and general administrative expenses -24.62 -6.30 8.43 -24.62 -6.28 8.40

Net income -67.82 -2,712.74 -118.84 -62.85 -14,842.44 -97.51

Gross profit -384.47 -121.25 -31.48 -384.47 121.25 -31.48

45